Introduction: Average price tag on a home rose by just £14 in February

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices remained stagnant this month, despite a rebound in demand from buyers as the disruption following the mini-budget chaos fades.

The average asking price for a home increased by just £14 month-on-month in February, according to property website Rightmove this morning.

That’s the smallest increase recorded between January and February since Rightmove’s records began in 2001.

More sellers are “heeding their agents’ advice to price right first time” and being more realistic about what their property is worth, Rightmove says.

Increasing numbers of buyers are returning to the market as mortgage rates fall back, it reports, with the number of potential buyers contacting agents is up by 11% in the last two weeks compared with the same period in 2019.

On an annual basis, asking prices were 3.9% higher than a year ago in February, down from 9.3%/year in July.

Today’s report shows:

The number of sales agreed continues to rebound, and is now just 11% down on 2019’s levels, recovering from 15% down at the start of the year, and 30% down in the aftermath of the mini-budget

Average rates for a 15% deposit five-year fixed mortgage are now 4.82%, down from October’s 5.90%

Although the housing market has slowed, it has started 2023 “much better than many expected”, Rightmove reckons. That could be a sign that the market will experience a “softer landing” than many expected, the company says.

Tim Bannister, Rightmove’s Director of Property Science says:

The big question this month was whether we would see new sellers increasing their asking prices as has been the yearly norm as we approach the spring selling season. This month’s flat average asking price indicates that many sellers are breaking with tradition and showing unseasonal initial pricing restraint.

In addition to market conditions demanding greater realism on price, we are transitioning into a slower paced market, where buyers will take longer to find the right property at the right price due to the higher cost of servicing a mortgage.

There are other indicators that this will be a softer rather than a hard transition despite the turbulence at the end of 2022.

Homeowners who are coming to market in the upcoming spring season should use their agent’s expertise and get the price right the first time , which can really help to find the right buyer more quickly.

Data from building society Halifax has shown that prices paid for houses were flat in February, after falling for the previous three months.

At the end of last year, economists predicted that prices will fall by between 5% and 12% in 2023, although a worst-case scenario could mean a crash of 15% to 20%, they warned.

Also coming up today

Britain’s retail crisis has claimed almost 15,000 jobs since January, in what one leading retail expert called “a brutal start to the year”.

According to figures compiled by the Centre for Retail Research (CRR), 14,874 jobs have been cut from high streets and top shopping destinations during January and February.

Most of the jobs being shed — 11,689 — are due to cost-cutting progrmmes at large retailers, with 3,185 jobs are being lost through insolvency procedures.

National retailers including stationery brand Paperchase, clothing chain M&Co and Tile Giant have all gone bust in recent weeks, while discount retailer Wilko, clothing retailer New Look and supermarkets Tesco and Asda have all also announced job cuts, my colleague Joanna Partridge explains.

More here:

Germany’s central bank, the Bundesbank, releases its latest economic assessment this morning… we also get the latest consumer confidence report, and a healthcheck on European building firms.

European stock markets are set to begin the new week with small gains, while Wall Street is closed for President’s Day.

The agenda

8am GMT: China FDI (foreign direct investment) data for January

9.30am GMT: Impact of increased cost of living on adults across Great Britain: September 2022 to January 2023

10am GMT: Eurozone construction output report

11am GMT: German Bundesbank’s monthly report

3pm GMT: Eurozone consumer confidence report

Key events

In the City, shares in retail group Frasers are leading the FTSE 100 risers after it announced a new sharebuyback programme this morning.

Frasers, which owns Sports Direct, plans to spend up to £80m buying back its stock.

This has pushed up its share price by 2.7% to 790p.

This could help Frasers hold onto its spot in the blue-chip index. It is currently the smallest company on the FTSE 100, putting it at risk of demotion to the smaller FTSE 250 index when the quarterly reshuffle is calculated next week.

UK house prices: What the estate agents say

There’s been increased activity in the housing market this month, estate agents say, as calm returns after the turmoil following last September’s mini-budget.

Matt Thompson, Chestertons’ head of sales, reports a pick-up in interest from potential buyers:

“This month, we have so far seen a 17% uplift in viewings and 14% decrease in withdrawals. This shows us that there are currently fewer window shoppers and the buyers who are entering the market are more serious about closing a deal.

For the remainder of February, as mortgage products have already come down, we expect to see more buyers wanting to capitalise on favourable rates before we enter the spring market which is expected to get more competitive due to pent-up demand.”

Tom Bill, head of UK residential research at Knight Frank, says the market has been ‘surprisingly strong’ so far this year:

“The six weeks since Christmas have been markedly different from the chaotic final three months of last year for the UK property market.

Buyers and sellers switched off early for the holidays due to the volatility caused by the mini Budget but have come back surprisingly strongly in 2023. The crucial difference is stability in the mortgage market, which means plans have been reactivated.

The true strength of the market will be put to the test in spring, along with the price expectations of sellers. As budgets come under pressure, we expect prices to fall by around 5% this year.”

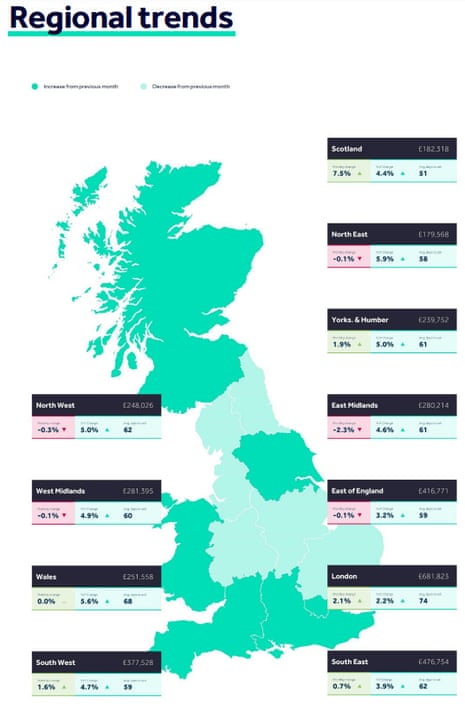

Across Britain, asking prices rose most quickly in Scotland this month (up 7.5% during February).

It was followed by London (+2.1% month-on-month), Yorkshire & Humber (+1.9%), the South West (+1.6%) and the South East (+0.7%).

Prices were flat in Wales, but dropped this month by 2.3% in the East Midlands. There were small declines in the rest of the country.

Property prices are surging across north London, Rightmove’s asking price index for this month shows.

Asking prices for homes in Camden surged 17.2% from a year ago, lifting the average price to nearly £1.16m.

Camden was followed by Barnet and Islington, where asking prices were up around 8% year-on-year, then Haringey (+7.1%) and Sutton (+6%).

Kensington and Chelsea was the only London borough where asking prices were lower than a year ago, down 2.2% – at nearly £1.65m, the priciest part of the capital.

Rightmove’s report also shows how house price affordability has worsened over the last year, making it even harder to get onto the housing ladder:

Bloomberg reported last week that housing affordability is the worst since 1876 (based on the gap between wages and house prices), as calculated by Duncan Lamont at Schroders (details here).

First-time buyer sales holding up most strongly

Demand from first-time buyers could be holding the UK housing market up.

Rightmove reports that sales in the first-time buyer sector held up most strongly in the first half of February, and were only 7% lower than in 2019 – while the wider market was 11% lower than three years ago.

But sales at the top of the housing ladder are rather weaker, down 16% in the first two weeks of February compared with the same time in 2019.

High and increasing rents may be driving first-time buyers to complete deals, although interest rate increases mean mortgages cost more than a year ago.

Rightmove’s Tim Bannister says:

Agents are reporting that they are now increasingly seeing buyers who have more confidence and more choice albeit with revised budgets to accommodate higher mortgage rates.

It’s a positive sign for the market to see many in the first-time buyer sector getting on with their moves, though despite average mortgage rates having edged down, some first-time buyers will still be priced out of their original plans and may need to look for a cheaper property, save a bigger deposit, or factor higher monthly mortgage repayments into their budgets.

Introduction: Average price tag on a home rose by just £14 in February

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK house prices remained stagnant this month, despite a rebound in demand from buyers as the disruption following the mini-budget chaos fades.

The average asking price for a home increased by just £14 month-on-month in February, according to property website Rightmove this morning.

That’s the smallest increase recorded between January and February since Rightmove’s records began in 2001.

More sellers are “heeding their agents’ advice to price right first time” and being more realistic about what their property is worth, Rightmove says.

Increasing numbers of buyers are returning to the market as mortgage rates fall back, it reports, with the number of potential buyers contacting agents is up by 11% in the last two weeks compared with the same period in 2019.

On an annual basis, asking prices were 3.9% higher than a year ago in February, down from 9.3%/year in July.

Today’s report shows:

The number of sales agreed continues to rebound, and is now just 11% down on 2019’s levels, recovering from 15% down at the start of the year, and 30% down in the aftermath of the mini-budget

Average rates for a 15% deposit five-year fixed mortgage are now 4.82%, down from October’s 5.90%

Although the housing market has slowed, it has started 2023 “much better than many expected”, Rightmove reckons. That could be a sign that the market will experience a “softer landing” than many expected, the company says.

Tim Bannister, Rightmove’s Director of Property Science says:

The big question this month was whether we would see new sellers increasing their asking prices as has been the yearly norm as we approach the spring selling season. This month’s flat average asking price indicates that many sellers are breaking with tradition and showing unseasonal initial pricing restraint.

In addition to market conditions demanding greater realism on price, we are transitioning into a slower paced market, where buyers will take longer to find the right property at the right price due to the higher cost of servicing a mortgage.

There are other indicators that this will be a softer rather than a hard transition despite the turbulence at the end of 2022.

Homeowners who are coming to market in the upcoming spring season should use their agent’s expertise and get the price right the first time , which can really help to find the right buyer more quickly.

Data from building society Halifax has shown that prices paid for houses were flat in February, after falling for the previous three months.

At the end of last year, economists predicted that prices will fall by between 5% and 12% in 2023, although a worst-case scenario could mean a crash of 15% to 20%, they warned.

Also coming up today

Britain’s retail crisis has claimed almost 15,000 jobs since January, in what one leading retail expert called “a brutal start to the year”.

According to figures compiled by the Centre for Retail Research (CRR), 14,874 jobs have been cut from high streets and top shopping destinations during January and February.

Most of the jobs being shed — 11,689 — are due to cost-cutting progrmmes at large retailers, with 3,185 jobs are being lost through insolvency procedures.

National retailers including stationery brand Paperchase, clothing chain M&Co and Tile Giant have all gone bust in recent weeks, while discount retailer Wilko, clothing retailer New Look and supermarkets Tesco and Asda have all also announced job cuts, my colleague Joanna Partridge explains.

More here:

Germany’s central bank, the Bundesbank, releases its latest economic assessment this morning… we also get the latest consumer confidence report, and a healthcheck on European building firms.

European stock markets are set to begin the new week with small gains, while Wall Street is closed for President’s Day.

The agenda

8am GMT: China FDI (foreign direct investment) data for January

9.30am GMT: Impact of increased cost of living on adults across Great Britain: September 2022 to January 2023

10am GMT: Eurozone construction output report

11am GMT: German Bundesbank’s monthly report

3pm GMT: Eurozone consumer confidence report

1 year ago

92

1 year ago

92

English (US)

English (US)