UK avoids falling into recession

Newsflash: The UK has avoided falling into recession at the end of last year.

The Office for National Statistics reports that UK GDP was flat in the last quarter of 2022, as economists had expected.

That follows the 0.3% contraction recorded in the third quarter of last year, meaning Britain has avoided the technical definition of a recession – two consecutive quarters of contraction in a row.

But, the economy did contract in December, as feared, by 0.5%.

The ONS says:

The first quarterly estimate of UK real gross domestic product (GDP) shows there was no growth in Quarter 4 (Oct to Dec) 2022.

Monthly estimates published today show that GDP fell by 0.5% in December 2022, following an unrevised growth of 0.1% in November 2022.

In output terms, the services sector slowed to flat output on the quarter driven by falls in the education, and transport and storage sub-sectors.

Elsewhere, growth of 0.3% in construction was offset by a 0.2% fall in the production sector in Quarter 4 2022.

Key events

Despite the typical seasonal boost to spending around the Christmas period, December suffered a sharp economic sharp contraction which meant that the UK economy logged zero growth during the final quarter of 2022, says Victoria Scholar, head of investment at Interactive Investor.

December’s growth was negatively impacted by industrial action across the UK with postal strikes, a hit to public services and lower school attendance. On top of that the Premier League football’s pause for the FIFA World Cup also had a negative impact on UK GDP. Lingering double-digit inflation also continues to weigh on consumer confidence, spending and business margins.

The Bank of England has recently rolled back its highly pessimistic forecasts from last year for the UK economy to face the longest recession since records began. Instead in the final quarter of 2022, it was projecting growth of 0.1%, which the official data just fell short of this morning.

Although the UK managed to technically stave off a recession, the growth picture remains bleak weighed down by industrial action and sky-high inflation which is driving the cost-of-living crisis for consumers and a cost of doing business crisis too. The UK central bank is in the unenviable position of trying to raise interest rates to the extent that price pressures cool without inadvertently tipping the economy into a recession.

Today’s GDP report includes some “worrying developments”, warns David Bharier, head of research at the British Chambers of Commerce.

Bharier points out that output in the production sector shrank in the last quarter.

He says companies were hit by high energy prices, and also face headwinds including continuing strike action and further uncertainty around Britain’s trading relationship with Europe.

Production output fell by 0.2% in Q4 2022, eight of the 14 service sectors saw contractions, and monthly GDP fell by 0.5% in December.

“Small businesses have seen three years of economic shocks, including lockdowns, global supply chain crises, Brexit, and soaring energy costs.

“Our research has shown that most small firms have seen no improvements to sales, exports, or investment. Retailers and hospitality firms are among the worst affected as consumer confidence takes a hit.

ONS: anecdotal evidence that strikes hit economy

There is “anecdotal evidence” to suggest that industrial action had an impact across a wide range of industries in December, the Office for National Statistics says.

In its December GDP report, the ONS says there is anecdotal evidence to suggest that rail strikes had negatively impacted some businesses.

Most comments were received from restaurants, caterers, hotels and bars, but other affected units included those engaged in the manufacture of jewellery, the wholesale of food, beauty treatments and the wholesale of wine. Units involved in car hire and in land transport reported an increase in turnover because of the rail strikes.

There was also anecdotal evidence that postal strikes had negatively impacted some businesses, the statistics body explains:

The units affected included businesses engaged in financial planning, hospitality, computer repair, and management consulting.

Other units affected include those involved in the manufacture of metal doors and windows, blankets and jewellery and the wholesale of flowers, watches, garden furniture, computer equipment, optical equipment, motor vehicle parts, and households’ goods.

UK escapes recession "by the skin of its teeth"

The UK has escaped recession by the skin of its teeth, says Jeremy Batstone-Carr, European Strategist at Raymond James Investment Services.

Batstone-Carr points out that the cost of living crisis will continue to hit households this year:

Today’s figures confirm that the UK has escaped recession by the skin of its teeth in 2022. With December’s contraction of 0.5%, skirting recession by the slimmest of margins, the UK has achieved a minor economic victory.

November’s 0.1% growth came as a significant surprise, with England’s footballers providing sufficient cheer to temporarily offset the negative effects of elevated inflation and rising rates. But the footballers have now packed up and come back home, bringing an end to this economic reprieve.

We are still in for the downturn which so far has been barely kept at bay. It will be shorter and shallower than previously thought, as per the Bank of England’s forecasts. The lagged impact of earlier base rate increases combined with additional policy tightening will ensure it happens.

However, whether we are officially in recession will not make much difference to most people – it will simply feel like a continuation of the present sluggishness and cost-of-living woes.

Full story: UK narrowly avoids recession after figures show growth flatlining

Phillip Inman

The UK narrowly avoided entering a recession at the end of last year, official figures reveal, after economic growth was flat in the final three months of 2022, my colleague Phillip Inman reports.

However, the economy did contract in December, as feared – by 0.5% - following a growth figure of 0.1% in November and 0.55% in October.

Negative growth in the fourth quarter would have signalled recession, after the economy shrank by 0.3% in the third quarter, according to the figures from the Office for National Statistics. A technical recession is generally defined as two consecutive quarters of negative growth.

With the cost of living crisis eating into household spending power and many small businesses struggling to stay afloat, few economists expected a strong performance in the run-up to the festive season.

Jeremy Hunt says economy is resilient after avoiding recession

Chancellor Jeremy Hunt says has warned that the UK economy is not out of the woods, after narrowly swerving a recession in the last quarter.

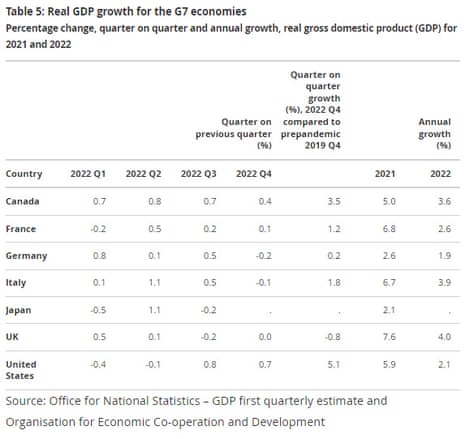

Hunt says the economy is showing more resilience than expected, pointing out that the UK’s 4% growth during 2022 is faster than other advaned economies.

He says:

“The fact the UK was the fastest growing economy in the G7 last year, as well as avoiding a recession, shows our economy is more resilient than many feared.

“However, we are not out the woods yet, particularly when it comes to inflation.”

UK shrank 0.5% in December alone

Britain’s service sector had a rough December.

Services sector GDP shrank by 0.8% in December alone, today’s flurry of GDP data shows, which helped to drag the wider economy down by 0.5% in December.

Strikes and the postponement in Premier League football both hit the economy in December.

Darren Morgan, director of economic statistics at the Office for National Statistics (ONS), says:

“The economy contracted sharply in December meaning, overall, there was no growth in the economy over the last three months of 2022.

“In December public services were hit by fewer operations and GP visits, partly due to the impact of strikes, as well as notably lower school attendance. Meanwhile, the break in Premier League football for the World Cup and postal strikes also caused a slowdown.

“However, these falls were partially offset by a strong month for lawyers, growth in car sales and the cold snap increasing energy generation.

“Across 2022 as a whole, the economy grew 4%, Morgan adds:

Despite recent squeezes in household incomes, restaurants, bars and travel agents had a strong year.

“Meanwhile, health and education also began to recover from the effects of the pandemic.”

On a quarterly basis, the UK economy was still 0.8% below its pre-coronavirus level, today’s GDP report shows.

That makes the UK the only G7 country that hasn’t recovered all the lost output due to Covid-19, Bloomberg points out:

For 2022 at a whole, UK GDP increased by an estimated 4.0%, following a 7.6% increase in 2021, the Office for National Statistics says.

UK avoids falling into recession

Newsflash: The UK has avoided falling into recession at the end of last year.

The Office for National Statistics reports that UK GDP was flat in the last quarter of 2022, as economists had expected.

That follows the 0.3% contraction recorded in the third quarter of last year, meaning Britain has avoided the technical definition of a recession – two consecutive quarters of contraction in a row.

But, the economy did contract in December, as feared, by 0.5%.

The ONS says:

The first quarterly estimate of UK real gross domestic product (GDP) shows there was no growth in Quarter 4 (Oct to Dec) 2022.

Monthly estimates published today show that GDP fell by 0.5% in December 2022, following an unrevised growth of 0.1% in November 2022.

In output terms, the services sector slowed to flat output on the quarter driven by falls in the education, and transport and storage sub-sectors.

Elsewhere, growth of 0.3% in construction was offset by a 0.2% fall in the production sector in Quarter 4 2022.

Any relief if the UK has avoided recession at the end of last year will be short-lived, fears Adam Cole, chief currency strategist at RBC Europe.

Cole predicts the economy will shrink in the current quarter:

The monthly GDP outturns for October and November and December mean that the UK economy likely avoided a recession in calendar year 2022, if only just.

Relief is likely to be short lived, however. The January PMI surveys suggested that activity weakened at the beginning of Q1 2023 and we currently see GDP contracting by 0.3% q/q.

How GDP measures everything except that which makes life worthwhile

Today’s GDP reportwill give a closely watched healthcheck on the UK economy.

It will estimate how much (if any) economic growth was achieved, based on the value of all the goods and services that were produced, during the last quarter of 2022 and also just in December.

Gross domestic product is an imperfect measure, though, some economists say. It fails to capture concepts such as well-being, or to distinguish between harmful activities and beneficial ones.

In 1968, Robert Kennedy gave a famous rebuttal of GDP, saying it measures everything “except that which makes life worthwhile.”

Kennedy explained, in an excellent, witty speech to the University of Kansas during his presidential run, that:

It counts the destruction of the redwood and the loss of our natural wonder in chaotic sprawl. It counts napalm and counts nuclear warheads and armored cars for the police to fight the riots in our cities. It counts Whitman’s rifle and Speck’s knife, and the television programs which glorify violence in order to sell toys to our children.

Yet the gross national product does not allow for the health of our children, the quality of their education or the joy of their play. It does not include the beauty of our poetry or the strength of our marriages, the intelligence of our public debate or the integrity of our public officials.

It measures neither our wit nor our courage, neither our wisdom nor our learning, neither our compassion nor our devotion to our country.

Here’s a clip of the speech, given three months before Kennedy’s assassination:

Sunak and Hunt to meet business leaders for talks on boosting economy

Phillip Inman

Rishi Sunak and Jeremy Hunt will host some of the UK’s most prominent industry leaders today as part of a drive to drum up fresh investment to revive the UK’s struggling economy.

The prime minister, who is expected to attend remotely, and the chancellor will address 200 business executives – including many of the 42 bosses from commerce and industry who sit on the UK Investment Council – with a focus on creating jobs in hi-tech sectors.

Council members include executives from Airbus, HSBC, Nestlé, Nissan and Hutchison Whampoa, which owns the 3 UK mobile telephone network. The head of Saudi Arabia’s Public Investment Fund, the outgoing Legal & General CEO Sir Nigel Wilson and Liv Garfield, the Severn Trent CEO are also expected to attend.

The government said the event would build on the success of the inaugural Global Investment Summit in October 2021, which brought together more than 170 chief executives “to showcase the UK’s commitment to green investment ahead of Cop26”.

More here:

Deutsche Bank’s chief UK economist, Sanjay Raja, has predicted that the UK economy flatlined in the last quarter of 2022.

If he’s right (and we find out at 7am), then a technical recession will have been avoided.

But, Raja fears the UK is still in the middle of a downturn.

He told clients this week:

December GDP, we think, will shrink by 0.4% m-o-m, driven by broad-based weakness across construction, manufacturing and services sectors.

Why the steeper fall in December? Weather disruptions and labour disputes will likely push GDP a bit lower. Still very subdued sentiment will also continue to keep demand fairly weak to end the year. If our forecasts are broadly on the mark, 2022 GDP growth will land at 4.1%, with the UK registering its third-fastest expansion since 2000.

Where to now? While the UK may have just about avoided a technical recession in Q4-22, the UK is still very much in the middle of a downturn.

We also continue to think that a 2023 technical recession is very likely, with GDP contracting in both Q1 and Q2. Peak-to-trough, we see GDP down around 0.5%, before registering some modest growth in H2-23. Overall, we see UK GDP shrinking by 0.5% this year and growing 0.8% next year.

The UK economy surprised us a month ago with modest growth (+0.1%) in November, as pubs and bars enjoyed a boost from the men’s World Cup.

The football could have helped the economy grow in December too, says analyst Michael Hewson of CMC Markets this morning:

Tour operators and reservation services were positive contributors to November GDP with gains of 3.7% as people booked holidays for next year.

Working on the rather unscientific basis that the World Cup ended on 18th December, and England went out on the 10th there is the prospect that we might have avoided a Q4 contraction and thus avoided the “R” word, even when taking into account the disruptive nature of the strike action which disrupted peoples travel and shopping plans.

Introduction: UK GDP report to show if UK avoided recession.

Good morning. Today we discover if Britain avoided falling into recession at the end of last year.

The Office for National Statistics will release its first estimate of UK GDP for December, and for the final quarter of 2022, at 7am this morning.

If the economy shrank in October-December, then the UK will be in a technical recession – defined as two quarters of contraction in a row. UK GDP has already shrunk in the July-September quarter, by 0.3%, so a second quarterly fall in activity would mean a recession.

But… experts predict that the economy probably stagnated in Q4, with no growth, as the UK was hit by soaring inflation, the energy price squeeze, and strikes on the railways, within the health services, and beyond.

If GDP is flat, then the recession will have been dodged – for now anyway.

Samuel Tombs at City firm Pantheon Economics said he thinks that GDP hit 0.0% growth in the last three months of 2022.

In a research note this week, Tombs explained:

“Heavy snow in mid-December appears to have hit retail sales and construction output. In addition, the hospitality sector struggled during December’s rail strikes.

“Meanwhile, surveys suggest that manufacturing output continued to fall.”

We already know that the UK economy grew in October and November, as activity picked up from September when there was a bank holiday for Queen Elizabeth’s funeral.

For December alone, the UK economy is forecast to have contracted by 0.3%, following 0.1% growth in November which raised hopes a recession could be avoided in 2022.

Whatever happened at the end of 2022, it’s clear that 2023 will be tough – with some forecasters predicting the UK economy will contract this year.

However, earlier this week, the National Institute of Economic and Social Research (NIESR) said it expects the UK to avoid a protracted recession this year. But, high inflation means it will still “feel like a recession” at least for seven million of the poorest households, NIESR said.

The IMF predicted last week, though that Britain will be the only major industrialised country to see its economy shrink this year.

The agenda

7am GMT: UK GDP report for December, and the fourth quarter of 2022

7am GMT: UK trade balance for December

9.30am GMT: UK business investment figures for Q4 2022

10.30am GMT: Russia’s central bank sets interest rates

3pm GMT: University of Michigan index of US consumer sentiment

1 year ago

103

1 year ago

103

English (US)

English (US)