UK inflation slowed faster than expected to 10.1% in January

Newsflash: UK inflation slowed to an annual rate of 10.1% in January, according to the Office for National Statistics’ consumer prices index.

That indicates prices across the economy did not rise as quickly as expected in January after a 10.5% reading in December. Economists had predicted a rate of 10.3%.

Key events

Glencore profits triple as it benefits from higher oil and coal prices

If you want to know where some of that money for higher energy prices has gone, here is a handy reminder: commodities company Glencore has reported record annual profits, helped by high oil prices and record coal prices.

The company will reward its shareholders with $7.1bn (£5.8bn) in dividends and share buybacks, it said.

Net profits more than tripled from $5bn in 2021 to $17.3bn in 2022, the FTSE 100 company reported on Wednesday. Its revenues rose 26% – or more than $50bn – to $256bn.

Oil trading profits were a big source of its profits, and its sales of coal benefited from record high prices.

Glencore’s chief executive, Gary Nagle, is pretty clear in what has driven the record profits for the company. He said:

The global pandemic, recovery from it and years of underinvestment, followed by conflict in Europe, exposed pre-existing vulnerabilities in energy security and supply chains, underpinning the generally high and volatile 2022 commodity price environment, which enabled the group to generate record profitability for the year.

And Glencore also noted that its shareholders are on board with its strategy – despite the huge impact that its products have in carbon emissions and other pollutants. It said:

A limited number of shareholders looked for opportunities to accelerate our current total emissions reduction pathway (50% reduction by 2035), while some raised the prospects for incremental growth in our coal production. However, the overwhelming majority of shareholders reiterated their support for our current responsibly managed coal decline strategy and associated targets.

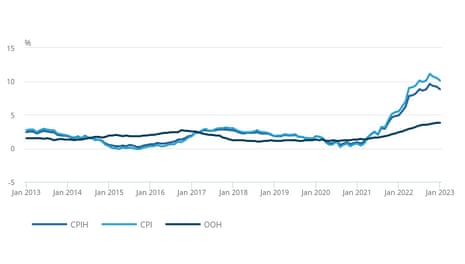

Here is the inflation summary for the last decade: fairly steady around the Bank of England’s 2% annual target, and then lift-off in 2021.

The soaring price pressures were caused by supply chain disruption from the coronavirus pandemic lockdowns, and worsened by the energy crisis caused by Russia’s invasion of Ukraine which helped inflation increase further from February 2022.

Sterling has dipped further following the lower-than-expected inflation reading.

The pound is now down by 0.6% for the day at about $1.2102 against the US dollar.

Lower inflation might suggest that the doves at the Bank of England could hold sway, and interest rates may not have to rise as far as expected by markets. That in turn makes the pound less attractive to foreign investors.

The Bank’s chief economist, Huw Pill, has already indicated that monetary policymakers are concerned about increasing rates too much – a move that would choke off inflation but could also slow already meagre economic growth (or rather, stasis, in the case of the last quarter). Earlier this month he said:

It is important we do enough to attain our objective to return inflation to within the 2% target. But of course it is also important that we guard against the possibility of doing too much. We need to keep that zen-like balance in our objective.

The inflation data show a pretty marked fall in inflation during January: the headline measure, CPI, fell by 0.6% in January, compared with a fall of 0.1% in January 2022.

The biggest contributor to the decline was transport (particularly passenger transport and motor fuels), and restaurants and hotels, the Office for National Statistics (ONS) said.

Fuel prices have, of course, been one of the most notable inflationary pressures over the past year – along with anything energy-related – after Russia’s invasion of Ukraine roiled energy markets. Energy prices have eased somewhat, helped by a warm winter in Europe, meaning inflation was always likely to fall back.

But that was partially offset by rising prices in alcoholic beverages and tobacco, the ONS said.

UK inflation slowed faster than expected to 10.1% in January

Newsflash: UK inflation slowed to an annual rate of 10.1% in January, according to the Office for National Statistics’ consumer prices index.

That indicates prices across the economy did not rise as quickly as expected in January after a 10.5% reading in December. Economists had predicted a rate of 10.3%.

Ahead of the UK inflation data, a quick look at where we stand on financial markets.

Sterling is down 0.25% against the US dollar in early trading, at about $1.2140.

FTSE 100 futures suggest London’s blue-chip shares will dip by about 0.2% on opening.

Asian stock market indices in China and Hong Kong fell. Reuters explained:

Asian stocks slipped while the US dollar held firm on Wednesday following US inflation data and remarks from central bank officials that have investors worrying interest rates are going to be higher for longer.

Inflation expected to slow in January - poll of economists

Good morning, and welcome to our live, rolling coverage of business, economics and financial markets.

Rising energy prices, food prices, broadband prices – the UK economy has been under pressure from inflation since the start of 2021. Today we will find out if those pressures have eased, with the Office for National Statistics due to publish the latest inflation data shortly.

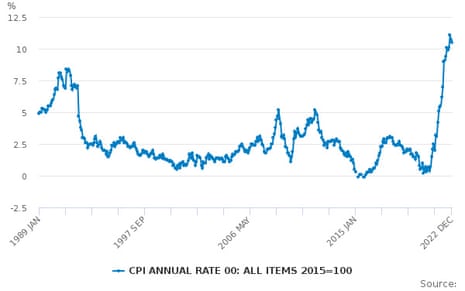

Economists polled by Refinitiv expect the annual rate of the consumer prices index of inflation to drop to 10.3%, down from 10.5% in December. Inflation peaked at a 41-year high of 11.1% in October.

The price pressure was prompted, at least in part, by disruption to global supply chains caused by the coronavirus pandemic lockdowns (and whiplash in the subsequent recovery). Russia’s invasion of Ukraine almost a year ago stoked the fires further by pushing up global energy prices.

Yet now economists believe the UK may have turned a corner, and are preparing for price growth to slow over the course of the year.

Sanjay Raja, a senior economist at Deutsche Bank, said he expects consumer prices index inflation to start a long march from the double digits to about 4% by the final quarter of this year. In a note to clients, he wrote:

After a second consecutive drop in annual inflation to end 2022, we expect headline inflation to continue its slow descent to start 2023. If our inflation projections are broadly on the mark, CPI inflation will register its first monthly drop in 12 months.

Easing inflationary pressures due to falling energy prices. Looking ahead, we continue to see inflation slowing down more acutely from H2-23. Falling expected energy prices, easing core goods inflation, and lower food prices over the course of the year will continue to drag on price momentum.

Yet even if price increases slow, UK households are still expected to have a tough time this year.

Edward Allenby, a UK economist at Oxford Economics, a consultancy, said he expects real income (adjusting for inflation) to fall by 1.2% in 2023. Inflation, rising mortgage costs as interest rates rise, and a slight tightening of government spending will all contribute to that drop in living standards, he said.

UK consumers endured a torrid year in 2022, as very high inflation weighed on spending power. We estimate that real household disposable income fell by 1.7% over the calendar year, which would be the biggest year decline since 2011. This year will be another challenging one for household finances as inflation is set to remain high, fiscal policy is being tightened, and mortgage costs will rise.

So the chances of avoiding a large fall in consumer spending are likely to rest on consumers saving less or borrowing more than they currently do – neither of which they have shown any inclination to do so far.

Much more detail to come after 7am GMT.

The agenda

10am GMT: Eurozone industrial production (December; previous: 2% year-on-year; consensus: -0.7%)

1:30pm GMT: US retail sales (January; prev.: -1.1% month-on-month; cons.: 1.8%)

2pm GMT: Christine Lagarde, president of the European Central Bank, at European parliament

1 year ago

72

1 year ago

72

English (US)

English (US)