UK inflation falls to 10.1% in March

Newsflash: UK inflation has dropped, but remains in double-digit levels, as the cost of living crisis eased slightly last month.

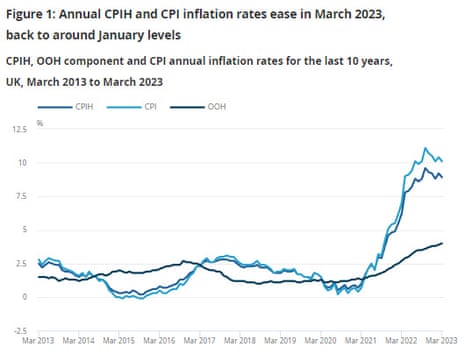

The annual consumer prices index dropped to 10.1% in March, down from 10.4% in February, the Office for National Statistics reports.

This suggests hard-pressed consumers are seeing some relief after months of soaring prices.

But it’s higher than hoped, as City economists had predicted a fall to 9.8%.

UK INFLATION (CPI)

YEAR ON YEAR

ACTUAL: 10.1%

FORECAST: 9.8%

PREVIOUS: 10.4%

Key events

Policymakers urged to tackle 'greedflation'

Dr George Dibb, head of the Centre for Economic Justice at the IPPR thinktank, is urging UK policymakers to get a grip on ‘greedflation’, after CPI inflation stuck in double-digits again in March.

Dibb says price hikes by companies to lift their profits are driving up the cost of living, rather than rising wages (which, at 6.6% in the last year, continue to lag inflation).

He explains:

“Household budgets are feeling the pressure from high inflation, which remains in the double digits according to new data. Even though petrol prices have fallen, the cost of essential items like food continues to rise.

“While families struggle to make ends meet, some companies continue to make higher profits from these price hikes, ignoring the impact on consumers.

It’s time for policymakers to look at ‘greedflation’ and prioritise reining in corporate profits, instead of blaming workers’ wages for driving up inflation.”

Last month, the Unite trade union reported that large corporations have fuelled inflation with price increases that go beyond rising costs of raw materials and wages

Bank of England policymaker Catherine Mann has also expressed concern that UK companies could be exploiting the cost of living crisis to push through inflation-busting price increases.

The European Central Bank is also concerned that consumers in the eurozone are suffering from price gouging.

It said last month it was paying just as close attention to trends in profits as to wages.

Here’s a breakdown of the price changes which kept UK inflation at 10.1% in March.

Food and non-alcoholic beverages: 19.1%

Alcoholic beverages and tobacco: 5.3%

Clothing and footwear: 7.2%

Housing, water, electricity, gas and other fuels: 26.1%

Furniture, household equipment and maintenance: 8.0%

Health: 7.1%

Transport: 0.8%

Communication: 3.7%

Recreation and culture: 4.6%

Education: 3.2%

Restaurants and hotels: 11.3%

Miscellaneous goods and services: 6.7%

Overall, goods prices rose by 12.8% in the year to March, while services inflation stuck at 6.6%.

BRC: poor harvests and weak pound pushed up food prices

The weak pound and poor harvests abroad drove up food prices in March, says Helen Dickinson, chief executive of the British Retail Consortium.

Dickinson explains:

Food prices, especially for fruit, vegetables and sugar, rose as poor harvests in Europe and North Africa reduced availability, and the weak pound made importing more expensive.

Meanwhile, discounting helped inflation to ease in other areas such as furniture, and clothing & footwear.

“With food price inflation likely to slow in the coming months as we enter the UK growing season, we expect wider inflation will continue to ease. Nonetheless, prices for consumers will remain high, especially as household bill support is lifted.

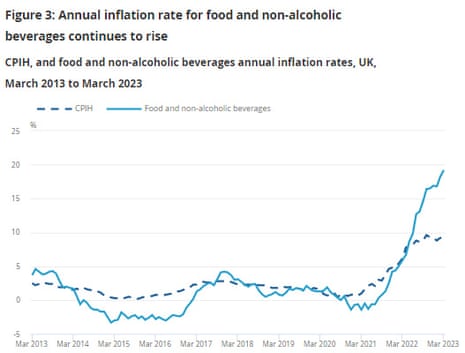

Food price inflation soars over 19%

Food prices accelerated at their fastest rate in over 45 years last month, adding to the inflation pain suffered by households.

Food and non-alcoholic beverages inflation jumped to 19.1% per year in March, today’s CPI inflation report shows. That’s up from 18% per year in February.

Food prices alone jumped by 19.6% per year; bread and cereal prices rose by 19.4%, while meat cost 17.4% more than in March 2022 and fish price jumped 16.7%.

Whole milk prices soared by 37.9%, while eggs rose 32%.

Olive oil cost 49.2% more than last year – with supplies disrupted by the Ukraine war.

Vegetable prices rose 19.3%, while fruit was 10.6% more expensive.

The ONS says that food and non-alcoholic beverage inflation is the highest seen for over 45 years, with “Indicative modelled estimates” suggesting that the rate would have last been higher in August 1977, when it was estimated to be 21.9%.

Paul Dales, chief UK economist at Capital Economics, says food price inflation “continued to defy gravity” by rising once again to a new multi-decade high.

Here’s chancellor Jeremy Hunt on the news that UK inflation was higher than expected last month:

“These figures reaffirm exactly why we must continue with our efforts to drive down inflation so we can ease pressure on families and businesses.

“We are on track to do this – with the OBR (Office for Budget Responsibility) forecasting we will halve inflation this year – and we’ll continue supporting people with cost-of-living support worth an average of £3,300 per household over this year and last, funded through windfall taxes on energy profits.”

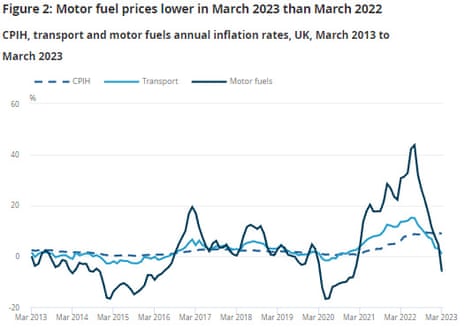

Petrol and diesel prices fall

Motor fuel prices fell year-on-year last month, pulling inflation down.

The ONS reports that motor fuel prices fell by 5.9% in the year to March 2023, compared with a rise of 4.6% in February.

Petrol prices fell by 1.2p per litre between February and March 2023, to an average price of 146.8p per litre – down from 160.2p/litre in March 2022.

Diesel prices fell by 3p per litre during last month, to 166.5p per litre, lower than the 170.5 pence per litre in March 2022.

But…..there were smaller upward pushes between February and March 2023 from transport services and, to a lesser extent, second-hand cars, the ONS adds.

So overall, the annual inflation rate for transport slowed from 3.1% in February 2023 to 1.0% in March 2023, the ninth consecutive monthly fall in a row since it peaked at 15.2% in June 2022.

At 10.1% in March, UK inflation has dropped back to January’s levels.

It has now remained in double-digit levels every month since last August (when inflation was 9.9%).

The Bank of England’s goal is to keep inflation at 2% in the medium-term.

On a monthly basis, the CPI inflation rate rose by 0.8% in March alone, the ON says.

That’s lower than the rise of 1.1% in March 2022, when the full-scale invasion of Ukraine drove up prices, but still a pacey monthly increase.

UK inflation falls to 10.1% in March

Newsflash: UK inflation has dropped, but remains in double-digit levels, as the cost of living crisis eased slightly last month.

The annual consumer prices index dropped to 10.1% in March, down from 10.4% in February, the Office for National Statistics reports.

This suggests hard-pressed consumers are seeing some relief after months of soaring prices.

But it’s higher than hoped, as City economists had predicted a fall to 9.8%.

UK INFLATION (CPI)

YEAR ON YEAR

ACTUAL: 10.1%

FORECAST: 9.8%

PREVIOUS: 10.4%

Ben Laidler, global markets strategist at investment platform eToro, says “fingers are crossed” that Wednesday’s March UK inflation report finally sees a long-awaited fall back into single digits.

Laidler adds:

“The latest 10.4% inflation rate is forecast to fall to 9.8%, with the focus on relief from high-flying food, restaurant, and utility price rises. This would still be by far the highest inflation amongst major economies given the UK’s unique mix of very low unemployment and high energy prices.

“The UK has endured double-digit inflation rates since last July, and any meaningful decline would be particularly welcomed by the Bank of England as they consider a 12th and final interest rate hike at their May 11th meeting.”

Economists at Investec are expecting a drop in UK inflation in a few minutes, saying:

“Following the significant upside surprise in the February numbers, we expect a clear easing back to have taken place in March.”

They said a drop would be largely driven by lower petrol prices as demand continues to recover globally, particularly given that the new data will compare with March 2022, where prices shot higher following Russia’s invasion of Ukraine.

Investec also added that “supply chain disruptions and lower shipping costs” could also result in falling goods prices for the month.

Full story: UK inflation expected to dip below 10% as energy prices fall

Larry Elliott

Andrew Sentance, a former member of the Bank of England’s monetary policy committee, said yesterday that the Bank was itself partly responsible for double-digit inflation, our economics editor Larry Elliott writes.

Sentance said the Bank had continued with its money creation programme – quantitative easing – for too long.

He told MPs on the Treasury committee:

“We had this long period of extremely low interest rates and further injections of QE after the immediate problems and the financial crisis have passed.

That all, I think, has contributed over a period of time to the inflationary pressures that we’re now seeing.”

More here:

Introduction: Did UK inflation fall last month?

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

Today we learn if the UK’s cost of living crisis has eased. New inflation data, due at 7am, is expected to show that prices rose at a slower rate in March.

The City of London is expecting inflation to fall to 9.8% per year last month, down from 10.4% in February.

A sharp fall in energy costs compared to March 2022, when the Ukraine war drove up prices, is thought likely to have dragged down inflation into single digits.

This would be the first time since last August that the consumer prices index has dropped below 10%. A fall would bring some relief to households, as they suffer a long real income squeeze.

It would also cheer both the Bank of England (which is meant to keep inflation at 2%), and the government (with Rishi Sunak pledging to halve the rate of inflation by the end of this year).

But….a month ago, economics were caught out when inflation actually rose in February.

Danni Hewson, head of financial analysis at AJ Bell, reminds us:

“The expectation is that the UK’s inflation reading will finally drop to single digits, but investors were caught on the hop last month after salad shortages and Valentine’s Day celebrations sent prices heading in the wrong direction.

“A second misstep is hugely unlikely as March was the month last year when prices at the pump shot up to record highs, an unpleasant portent of what was to come. By comparison this March was marked by falling retail sales and the comparison with those hikes last year should mean inflation finally falls below ten percent for the first time since last summer.

And even if inflation has fallen in March, prices will still be rising faster than pay.

Yesterday, we learned that regular pay rose by 6.6% per year in the three months to January.

Even if the economists’ prediction proves accurate, UK inflation will remain markedly higher than in the US and the eurozone, where it currently stands at 5% and 6.9% respectively.

The agenda

7am BST: UK CPI inflation report for March

7am BST: UK PPI index of producer prices for March

9.30am BST: ONS house price index for February

10am BST: Eurozone inflation report for March

Noon BST: US weekly mortgage application data

3.30pm BST: EIA weekly oil inventory data

1 year ago

71

1 year ago

71

English (US)

English (US)