Key events

With the exception of Greater London and the North East, all areas of the country experienced a slowdown in the rate of annual house price inflation last month, the Halifax data shows.

Northern Ireland continues to report the strongest annual growth in house prices of 4.9% (average house price of £186,459), followed by the West Midlands (3.8%, average price of £248,308).

In Wales, the rate of annual property price inflation has slowed to 1.0% (average property price of £213,959). Similarly in Scotland, the annual rate of growth fell to 2.3% (average price of £199,853).

Average house prices in London are up very slightly on this time last year (+0.1%) with the typical property now costing £537,250.

Tom Bill, head of UK residential research at the property group Knight Frank, said:

Activity has been solid but unspectacular in the UK housing market this year as the hangover from the mini-budget slowly fades. Prices are broadly in a holding pattern but will be tested this spring as supply rises and higher mortgage rates cause a sharp intake of breath among a growing number of buyers and homeowners.

We expect prices to fall by a few percent this year as the transition to the new normal for borrowing costs takes place.

Introduction: UK housing market stable as prices rise again in March

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

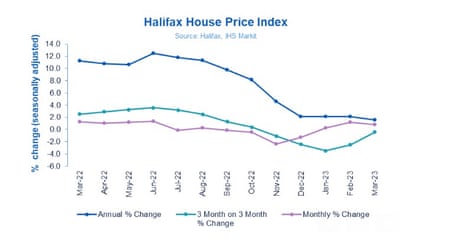

House prices across the UK rose for the third month in a row in March, while the annual rate slowed to the lowest in three and a half years.

This suggests that the market is stable, although a further slowdown throughout this year looks likely as mortgage costs have risen, said Halifax, which is part of Lloyds Banking Group.

A typical UK property now costs £287,880 (compared to £285,660 in February), according to the monthly house price index from Halifax.

Prices rose 0.8% in March from the month before following February’s 1.2% gain, and were up 1.6% on a year earlier, the slowest annual pace since October 2019.

House prices rose in all UK nations and regions last month, though the annual rate of growth continued to slow in most areas. Mortgage costs have risen as the Bank of England has raised interest rates 11 times to 4.25% to fight double-digit inflation (at 10.4% in February).

Kim Kinnaird, director of Halifax Mortgages, said:

The UK housing market continues to show resilience following the sharp downturn at the end of 2022, with average property prices rising again in March.

Predicting exactly where house prices go next is more difficult. While the increased cost of living continues to put significant pressure on personal finances, the likely drop in energy prices – and inflation more generally – in the coming months should offer a little more headroom in household budgets.

While the path for interest rates is uncertain, mortgage costs are unlikely to get significantly cheaper in the short-term and the performance of the housing market will continue to reflect these new norms of higher borrowing costs and lower demand. Therefore, we still expect to see a continued slowdown through this year.

The Halifax data has painted a more stable picture, while Nationwide Building Society’s house price index showed an 0.8% monthly drop in house prices, and an annual decline of 3.1%, the fastest since the aftermath of the financial crisis in 2009.

But other indicators, such as the Bank of England’s mortgage approvals data and property website Rightmove’s measure of asking prices have pointed to more stability in the housing market, after the Liz Truss government’s unfunded mini-budget caused chaos in the autumn.

UK housing market analyst Neal Hudson tweeted:

Matthew Thompson, head of sales at the estate agents Chestertons, said:

House hunters may not be seeing the drop in London property prices that they had hoped for. In March, the average price at which properties sold via our branches stood at £1.37m with neighbourhoods such as Putney, Fulham and Barnes being in particularly high demand with buyers.

Since the start of this year, many homeowners put their sale on hold to observe the market which has led to demand further exceeding the number of properties available for sale. This is resulting in properties keeping their value with little room for price negotiation. Throughout March, the majority of London sellers have therefore been able to secure their asking price or even receive higher offers from buyers.

The Agenda

8.30am BST: Eurozone S&P Global Construction PMI for March

9.30am BST: UK S&P Global/CIPS Construction PMI for March (forecast: 53.5)

1.30pm BST: US Initial jobless claims for week of 1 April (forecast: 200,000)

1 year ago

160

1 year ago

160

English (US)

English (US)