For Sale signs in Islington, north London. Photograph: Yui Mok/PA

Introduction: UK house prices rise in April after seven consecutive falls

Good morning, and welcome to our rolling coverage of business, the world economy and the financial markets.

UK house price growth picked up in April, building society Nationwide reports this morning, with the first monthly increase in seven month.

Average house prices rose by 0.5% last month, Nationwide’s data shows, following seven consecutive falls going back to last September.

The average price increased to £260,441, up from £257,122 in March.

This has lifted the annual rate of house price growth to -2.7%, from -3.1% in March (the biggest fall since 2009), as calm returned to the markets after the chaos of last autumn’s min-budget.

Robert Gardner, Nationwide’s chief economist, reports there were “tentative signs of a recovery” in the market last month, although this still leaves prices 4% below their August 2022 peak.

Gardner explains:

“Recent Bank of England data suggests that housing market activity remained subdued in the opening months of 2023, with the number of mortgages approved for house purchase in February nearly 40% below the level prevailing a year ago, and around a third lower than pre-pandemic levels.

However, in recent months industry data on mortgage applications point to signs of a pickup.

Last month, Rightmove reported that asking prices were at record levels:

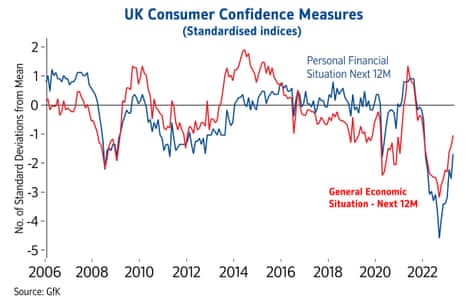

Gardner says the recent pick-up in UK consumer confidence may be helping the housing market, but cautions that….

….any upturn is likely to remain fairly pedestrian, as it will take time for household finances to recover, since average earnings have been failing to keep pace with inflation, and by a wide margin over the last few years.

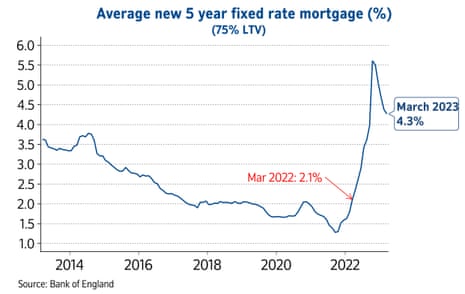

Mortgage interest rates are also likely to act as a headwind. While they are well below the highs seen in the wake of the mini-Budget last year, rates are still more than double the level prevailing a year ago.

Also coming up today

Britain’s biggest supermarkets are facing calls for the UK’s competition watchdog to investigate claims of profiteering amid the cost of living crisis, as food price inflation soared to a record high in April.

Overnight, Australia’s central bank has surprised investors by raising interest rates again.

The RBA board raised its cash rate 25 basis points to 3.85% at its monthly meeting on Tuesday, defying investors who had bet the central bank would extend its pause for a second month.

Higher interest rates lift profits at banks….. such as HSBC, which has reported a three-fold jump in earnings in the last quarter, On a constant currency basis, HSBC’s profit before tax increased by $9.0bn to $12.9bn, leading the bank to launch up to $2bn of share buybacks and a 10 cent-per-share dividend.

BP has defied an easing in energy prices to post one of the largest first-quarter profits in its history, reigniting a debate over windfall gains by oil and gas firms.

The energy giant said its underlying profits hit $5bn (£4bn) in the first three months of the year, outstripping analysts’ forecasts. More on this shortly…

The latest factory PMI reports will show how manufacturers in the UK and the eurozone fared in April. That follows a surprise contraction in China’s factory output, reported on Sunday.

We get the latest eurozone inflation report this morning, with prices expected to have risen by 7% in the 12 months to April, up from 6.9%. Core inflation could stick at 5.7%, worryingly high for the European Central Bank.

The agenda

7am BST: Nationwide house price index for April

9am BST: Eurozone manufacturing PMI for April

9.30am BST: UK manufacturing PMI for April

10am BST: Eurozone core inflation rate on April

3pm BST: US Factory Orders for March

Key events

Uber has delivered a rare earnings beat today, thanks to strong ride and delivery demand, says Adam Vettese, analyst at social investing network eToro.

Vettese explains:

This stock is perennially underwhelming for investors, especially when you consider the consistent lack of actual profits. But executives at the firm will be pointing gladly to their surprise EBITDA numbers as a sign that profitability is just a couple of stops away.

“Shrinking losses from $5.93 billion to just $157 million is no mean feat but there are some one-off outliers in the difference as the firm saw heavy investment losses in Q1 last year that flatter to deceive with these figures. That being said, the firm has greatly improved free cash flow, now a record $549 million, a key determinant of underlying health.

“In terms of its core businesses, demand has been sustained despite worries over consumers curtailing spending – something we’re beginning to see across travel and transport stocks. It also says it has dealt with some of the crippling driver shortages of recent months. The next signpost for wary investors is whether a potential recession and ensuing job losses will flag down demand where zooming inflation failed to stop it.”

Pfizer's Covid-19 vaccine sales slide

Declining sales of Pfizer’s Covid-19 vaccine have knocked its revenues this year.

Pfizer has reported a 29% drop in revenues in the first quarter of 2023, to $18.282bn from $25.661bn.

Revenues from Comirnaty, its Covid-19 vaccine, fell by 75% to $3.06bn from $13.227bn in Q1 2022.

Pfizer says the fall in Comirnaty sales was largely due to lower contracted deliveries and demand in international markets, as well as lower US government contracted deliveries.

But sales of Paxlovid, its Covid-19 antiviral treatment, rose to $4.07bn from $1.47bn a year earlier.

Dr. Albert Bourla, Pfizer’s chairman and chief executive officer, said an “unprecedented number” of new product launches were being planned, with most due in the second half of 2023.

Bourla says:

We have made excellent progress toward this goal already this year with the U.S. approvals for Zavzpret, Cibinqo for adolescents and Prevnar 20 in pediatric patients, and regulatory filing acceptances for a Braftovi + Mektovi sNDA, sNDA for the Talzenna and Xtandi combination, elranatamab BLA and our RSV maternal vaccine candidate — which, if approved, would be the first vaccine for administration to pregnant individuals to help protect against the complications of RSV disease in infants from birth up to six months of age.

Shares in Uber have jumped 8% in pre-market trading after it reported higher revenues than expected, and a smaller loss (see earlier post).

Victoria Scholar, head of investment at interactive investor, explains:

“Uber reported first quarter revenue of $8.82 billion, ahead of expectations for $8.72 billion. Quarterly gross bookings grew 19% to $31.4 billion or 22% on a constant currency basis. The ride hailing app reported a quarterly loss per share of $0.08, beating forecasts for a loss of $0.09.

Uber Eats has been successfully broadening its offering, shifting more towards alcohol and groceries to help navigate the economic storm clouds as the softening consumer looks to make cutbacks on non-essential spending like takeaways amid cost-of-living pressures.

Like a company that sells ice creams and umbrellas, Uber has a very well diversified business model with its taxi and food delivery offering. This helped Uber to navigate the pandemic much better than ride hailing rivals, thanks to its food delivery business Uber Eats which was a stay-at-home covid-proof winner while travel ground to a halt.

Nonetheless both taxi services and food delivery are likely to face headwinds from the challenging macroeconomic backdrop with slowing economic growth, cost inflation pressures and weak real wage growth. However, this has boosted demand for jobs in the gig economy with a greater supply of potential workers looking for supplementary income willing to take on roles at Uber.

For investors, shares had a tough time from the peak in April 2021 to the trough in July 2022 caught up in the US ‘tech wreck’ on the back of rising inflation and the Fed’s aggressive rate hiking path. As a result, Uber has been focusing on cutting costs. Off the lows, Uber has been rebounding with gains extending pre-market. The stock is up over 29% in 2023 until yesterday’s close and up a further 8% this morning. The read across is also providing a boost to shares in ride-hailing rival Lyft.”

Uber( $UBER ) just released their earnings report ♨️

🪙 EPS -$0.08 (Est -$0.09)🔺BEAT

💵 Rev $8.82B (Est $8.72B)🔺BEAT

📌

- Total rev up +29% y/y

- Mobility rev up +72% y/y

- Freight rev down -23% y/y

- Op loss down -46% y/y

- Op loss -$262M pic.twitter.com/o4Y1RxvnH2

Uber revenues surge

Uber, the ride hire and food delivery group, has grown its revenues by around a third, helping it to narrow its net loss.

Uber’s gross bookings grew 19% year-over-year to $31.4bn in January-March, including a 40% rise in mobility gross bookings and 8% in gross bookings for deliveries.

Trips during the quarter grew by 24% year-on-year to 2.1bn, or approximately 24 million trips per day on average. That lifted revenues to $8.8bn, up 29% compared with the first quarter of 2022 when the Covid-19 pandemic was hitting demand for journeys.

On an adjusted EBITDA basis, earnings rose 350% to $761m.

But the firm made a net loss of $157m in the quarter, a sharp improvement on the $5.9bn loss in Q1 2022, and a smaller loss than expected.

$UBER Earnings:

- Revenue grew 29% YoY to $8.8 billion, or 33% on a constant currency basis

- GAAP EPS of -$0.08

- Net loss attributable to Uber Technologies, Inc. was $157 million, which includes a $320 million net benefit (pre-tax) primarily due to net unrealized gains related… pic.twitter.com/EnO7PwvT06

Dara Khosrowshahi, Uber’s CEO, says:

“We significantly accelerated Q1 trip growth to 24% from 19% last quarter, with Mobility trip growth of 32%, as a result of improved earner and consumer engagement.

“Looking ahead, we are focused on extending our product, scale and platform advantages to sustain market-leading top and bottom-line growth beyond 2023.

Last summer, the Uber Files showed how the company broke the law, duped police and regulators, exploited violence against drivers and secretly lobbied governments across the world as it expanded rapidly.

Vice Media Group, the company behind popular media websites such as Vice and Motherboard, is preparing to file for bankruptcy, the New York Times reported on Monday, citing people with knowledge of its operations.

The report comes days after Vice shuttered its Vice News Tonight program, and amid waves of media layoffs and closures, including the end of BuzzFeed News.

Vice has received interest from five companies and might consider a sale to avoid bankruptcy, the Times report said, adding that in the event of a bankruptcy, which could happen in the coming weeks, Vice’s debt holder Fortress Investment Group could end up controlling the company.

More here:

The surprise rise in UK house prices, by 0.5% in April, reported this morning is lifting confidence that the property sector has stabilised.

Nicky Stevenson, managing director at estate agent group Fine & Country, said:

“This boost in activity is also coinciding with growing stock levels and, with property transactions starting to tick up, these are great signs of increasing confidence in the property market.”

Chris Barry, director at Gloucester-based conveyancer Thomas Legal, said:

“Yes, there is a long way to go and the potential for turbulence ahead but April’s Nationwide house price data is encouraging.”

Iain McKenzie, chief executive of the Guild of Property Professionals, said:

“The threat of an aggressive fall in property sales has failed to materialise and we are starting to see more mortgage applications being approved.”

ING: More rate rises likely as eurozone inflation rises

The rise in eurozone inflation in April, to 7%, shows that price pressures remain sticky in the euro area, says Carsten Brzeski, global head of macro at ING.

This underlines the need for further rate hikes, albeit at a slower pace and smaller magnitude than before, Brzeski predicts.

He expects the ECB to raise interest rates again, on Thursday, by another quarter-of-one-percent, or 25 basis points.

Over the last year, inflation in the eurozone, which started as a supply-side issue, has become a demand-side issue. This is a clear invitation for the ECB to continue hiking interest rates. While there is very little a central bank can do to lower oil prices or to stop a war, there’s a lot a central bank can do to stop too much money chasing too few goods: bring down demand. And this is exactly what the ECB will continue doing on Thursday. Even if headline inflation has come down and will come down further, this is not yet the moment of relief. The ECB doesn’t want to repeat the previous mistake of underestimating inflation and will therefore be willing to go too far, even if this eventually turns out to be a policy mistake.

The only open question is whether the ECB will go for 25bp or 50bp. Out in the open, only Austrian central bank governor Robert Holzmann has been advocating 50bp. The other hawks, like Isabel Schnabel, recently left the option of 50bp open but didn’t officially subscribe to it.

Despite the rise in overall inflation in the eurozone, there was a surprising move downwards in food inflation, as economist Kamil Kovar of Moody’s Analytics explains:

The biggest downside surprise in #eurozone #inflation came from food prices, which recorded overall small decline from previous month.

Combined with large base effect from last year, we got large decline in y/y, from 15.5% to 13.6%.

This was first since the surge started... pic.twitter.com/tC7GK4oRhn

While the magnitude and timing was surprising, the fact that food prices were soft was not.

It was really just a payback from the crazy jumps in Feb and Mar, which we knew is coming. What we did not know is that so much of it will come in April.

The good news is that more is in store.

Recent decline leaves unprocessed food prices still up on the year. Good chance all of this, and maybe more, will be undone in coming months. pic.twitter.com/nbF2yZQMzb

The goods news on unprocessed food should not hide the other good news in food.

In terms of SA m/m, processed food had smallest increase since beginning of last year.

Again, we expected moderation, but we might be getting it sooner/faster than we thought.

Here’s Daniel Kral, senior economist at Oxford Economics, on the rise in eurozone inflation:

The small rise in Eurozone headline inflation in April was not supposed to happen. Meanwhile core inflation was down only marginally. The @ecb is not done... pic.twitter.com/iw4ZFCL3tZ

— Daniel Kral (@DanielKral1) May 2, 2023Eurozone 'not out of the woods' as inflation rises

Inflation across the euro area has risen, as the cost of living squeeze hit families across Europe.

Euro area annual inflation is expected to be 7.0% in April 2023, up from 6.9% in March, according to a flash estimate from statistics office Eurostat.

Energy prices rose, by 2.5% compared with April 2022, up from a 0.9% year-on-year drop in March.

Food, alcohol & tobacco is expected to have the highest annual rate in April, at 13.6%, down from 15.5% in March, while non-energy industrial goods inflation slowed to 6.2%, from 6.6%.

But services inflation rose, to 5.2% from 5.1% in March.

Rising inflation puts more pressure on the European Central Bank to raise interest rates again, when it meets later this week.

But the ECB will be pleased to see that core inflation eased. Consumer prices, excluding energy, food, alcohol & tobacco, rose by 5.6% in the year to April, down from 5.7%/year in March.

Daniele Antonucci, chief economist & macro strategist at Quintet Private Bank, says inflation is far too high for the ECB to feel comfortable that it’s rapidly converging to target.

Contrary to the US Federal Reserve, which we expect to deliver a final rate hike this week before pausing to asses the impact of tighter financial conditions and banking-sector stresses, there are more rate increases on the cards in the euro area.

With core inflation higher than 5.5 per cent, it looks as if the euro area may have a worse inflation problem than the US. This is why we suspect the European Central Bank will reiterate that its job isn’t done just yet at this week’s press conference.

With credit conditions tightening and separate data revealing that the European consumer is getting squeezed, we also suspect that the near-term outlook remains rather challenging, with growth basically stagnating on the whole.

Whether this leads to a pause in central bank rates this side of the Atlantic too remains to be seen. For now, we think the incentive is to continue to make monetary policy more restrictive over the next few months.

This is likely to lead to further bouts of market volatility and economic weakness. Even though euro area growth has held up somewhat better than envisaged at the start of the year, we’re not out of the woods just yet.

UK factory downturn: what the experts say

The further contraction in UK manufacturing in April “makes for gloomy reading”, says Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply.

But there is a silver lining, he points out – falling demand led to an easing of both supply and inflationary pressures on the sector.

Glen says post-Brexit costs pushed down overseas demand:

The overall downturn was driven by subdued market sentiment and client cost cutting, with consumer and intermediate goods producers hardest hit. Falling exports demonstrated diminishing demand from EU, US and China for UK manufacturing in response to ongoing Brexit and trade-related costs.

The investment goods sector was the only notable bright spot, with export order growth hitting a 20-month high. “The lull in manufacturing activity did provide breathing space for supply bottlenecks to work their way out of the system, with improved material availability and shorter delivery times being reported.

While there is still uncertainty about the future and potential for further geopolitical instability to destabilise trade flows, there is hope that we are coming to the end of the significant supply chain disruption which has gripped the sector for the last three years.”

Maddie Walker, Industry X lead at Accenture UK, says the slowdown in rising costs is encouraging:

“These results are a reminder that it is going to be a rocky road to recovery for the UK’s manufacturing sector. However, it’s positive to see an optimistic outlook remaining amongst companies, with widespread expectation that output will rise during the coming year. It’s also encouraging to see cost increases starting to slow as well as delivery times shortening, in a sign that some of the supply chain issues that have defined the sector for the past few years are starting to ease.

Continued investment into supply chain resilience, digitisation and modernising the workforce will help stabilise manufacturers and position the sector well for a return to growth once demand improves.”

Rising interest rates and inflation have dampened demand for manufactured goods, points out Glynn Bellamy, UK Head of Industrial Products at KPMG:

“Supply has improved and some input costs have fallen, yet the UK manufacturing sector is struggling compared to some parts of the economy – as domestic and export demand for manufactured goods remains subdued by the cost of living crisis and short-term demand is adversely impacted by de-stocking in supply chains. The latter is the negative side of the easing of supply chain pressures and the unwind of the benefit many manufacturers experienced in 2021 and 2022 as there was a drive to build safety stock levels. Production volumes have subsequently fallen, costing jobs in the sector.

“Whilst some input costs have fallen, UK energy prices remain significantly in excess of those in North America and the Far East, placing ongoing pressure on UK competitiveness. Given these dynamics, UK manufacturing needs an upturn in global consumer confidence to lead to more big ticket purchasing, but manufacturers will be acutely aware how volatile the global consumer landscape remains, particularly with the ongoing uncertainty over future interest rate rises.”

HSBC rules out banking crisis as profits triple

Kalyeena Makortoff

HSBC’s chief executive has denied the possibility of a fresh banking crisis, saying the failure of four banks in six weeks was a merely a sign of poor risk management, as the lender tripled its own first quarter profits to $13bn (£10bn) after its rescue of Silicon Valley Bank UK.

Noel Quinn’s comments came a day after JP Morgan stepped in to buy most of the collapsed lender First Republic in a $10.6bn takeover, as part of regulators’ efforts to draw a line under lingering turmoil across the banking sector.

“We’re pleased that there was a resolution on First Republic at the weekend so that that situation has been resolved,” Quinn told journalists during a conference call on Tuesday.

“We do not believe that there is a global banking crisis on the horizon. We think there are some challenges that have been evidenced in some of the regional banks in the US, but we do not believe that’s systemic in the US, or across all banks.”

First Republic – which focuses on high net worth clients – is the fourth global bank to collapse since early March, after the failures of Silicon Valley Bank, the New York-headquartered lender Signature Bank and Switzerland’s second-largest bank, Credit Suisse.

More here:

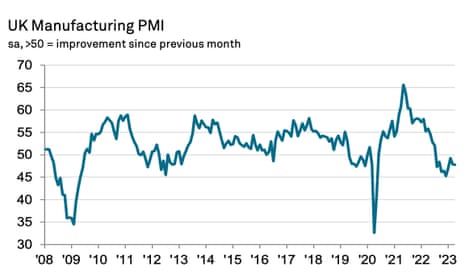

UK manufacturing downturn continues as demand falls

The downturn in the UK manufacturing sector continued in April as factories were hit by weak demand, the latest survey of factory purchasing managers shows.

April’s manufacturing PMI survey shows that output and new orders at UK factories contracted last month, as the manufacturing downturn continued.

Output, new orders, employment and stocks of purchases all contracted during April, with companies reporting a drop in demand, due to “client destocking” as customers tried to cut their costs.

This pulled the S&P Global / CIPS UK manufacturing PMI down to a three-month low of 47.8 in April, from 47.9 in March, below the 50-point mark showing stagnation – but better than the earlier flash estimate of 46.6.

New export orders contracted for the fifteenth consecutive month, with firms reporting softer demand from the US, China and mainland Europe.

But, there are also signs that supply chain pressures have eased. Manufacturers’ business optimism rose to 14-month high, while vendor delivery times shortened for the third successive month.

The rates of increase in average input costs and output charges both eased in April, falling to 35- and 28-month lows respectively.

The downturn in the #UK manufacturing sector continued in April (#PMI at 47.8; Mar: 47.9) amid sustained contractions in output and new orders. But there is a silver lining in the fact that supply and inflationary pressures eased on the month. Read more: https://t.co/TtSS4TDrnu pic.twitter.com/iub3OFVTXC

— S&P Global PMI™ (@SPGlobalPMI) May 2, 2023Rob Dobson, director at S&P Global Market Intelligence, said:

“The UK manufacturing sector remained in the doldrums at the start of the second quarter. Output and new orders contracted, as manufacturers felt the impacts of client uncertainty, destocking and tightening cost controls.

There was no escape from the subdued mood of the market, with both domestic and export customers remaining reticent to commit to new contracts.

But, the fall in supplier lead time is better news, helping to push down raw material price pressures, Dobson adds:

“Better-running supply chains have helped manufacturers reduce backlogs of orders, accumulated in prior months amid component shortages. But the concern is that these backlogs are being depleted, leaving firms with less work in hand.

There may be some light on the horizon, as manufacturers remain stoically optimistic about the outlook for the year ahead. Over 60% of firms expect to expand production over the next 12 months. But demand will need to pick up in the months ahead to warrant any increase in production, and with the UK seeing stubbornly high domestic inflation coupled with a worsening export trend, risks seem skewed to the downside.”

Eurozone factory downturn deepens, but input price pressures ease

The eurozone factory downturn deepened last month, according to the latest survey of purchasing managers, while raw material prices have dropped.

The HCOB final manufacturing Purchasing Managers’ Index (PMI), compiled by S&P Global, has fallen to 45.8 in April from March’s 47.3. That is slightly better than the ‘flash’ reading of 45.5, but well below the 50 mark separating growth from contraction for the 10th month in a row.

The PMI was pulled down by a drop in the cost of raw materials, which suggests inflationary pressures are easing. Firms reported the biggest drop in operating expenses in almost three years.

This allowed firms to slow their own price rises; the output prices index fell to a 29-month low of 51.6 from 53.4.

An index measuring output fell below the breakeven mark to 48.5 from 50.4.

Cyrus de la Rubia, chief economist at Hamburg Commercial Bank, says:

“This decline has been fairly broad-based across the euro zone, with regional PMI indices in France and Italy also showing a drop in output, while output in Germany and Spain was nearly stagnant.”

In Germany, retail sales have dropped by more than expected, as consumers in Europe’s largest economy retrench.

German retail sales fell by 2.4% in March in real terms from the previous month, the Federal Statistics Office reported this morning, meaning retail sales were down 8.6% year-on-year in real terms.

Analysts polled by Reuters had predicted a month-on-month increase of 0.4%.

German retail sales stumbled in March falling to 9% below their pre-pandemic trend on broad weakness. Likely a key reason for Q1 GDP coming in below expectations. Even allowing for some revisions that's a terrible carryover into Q2. https://t.co/P90VdXvWMO pic.twitter.com/JTtAlTu3OL

— Oliver Rakau (@OliverRakau) May 2, 2023European financial markets have made a subdued start to the new month.

The FTSE 100 index was slightly higher in early trading, led by rallying housebuilders (see earlier post), and HSBC (up 4.3% after announcing a share buyback following a jump in profits).

UK interest rates could rise up to 4.75% this year, economist predicts

The surprise rise in UK house prices in April is reigniting interest in how high the Bank of England may raise interest rates this year.

Professor Costas Milas, of the Management School at University of Liverpool, argues that the BoE could lift interest rates to 4.75% this year.

In a new blogpost, Professor Milas explains that high public expectations of inflation have the potential of putting additional pressure on current inflation through demand for higher wages.

But this prediction is conditional on financial stress not escalating further. If, instead, financial stress worries take over, UK interest rates might end up below 4% by the end of 2023, he suggests.

Professor Milas says:

In fact, there is growing expectation that the Chancellor of the Exchequer will increase the level for guaranteed UK deposits, from £85,000 currently. This suggests to me that UK regulators are somewhat worried that we have not fully escaped the risk of a financial/banking crisis.

Therefore, I do not rule out the possibility that the BoE will cut UK interest rates below 4 per cent by the end of the year.

JPMorgan’s move (over the weekend) to acquire most of failed US bank First Republic is a (constant) reminder that financial stress is not over.

The full blogpost is here:

1 year ago

180

1 year ago

180

English (US)

English (US)