UK house prices in biggest fall since 2009

UK house prices are falling at the fastest annual rate since the aftermath of the financial crisis, new data from Nationwide shows.

Nationwide reports that UK house prices fell for the seventh month running in March, as the aftermath from the disastrous mini-budget continued to hammer the housing market.

This month, they fell by 3.1% compared to a year ago, which is the largest annual decline since July 2009, Nationwide Building Society said.

Across the UK, prices fell by 0.8% month on month, leaving the average UK house price at £257,122.

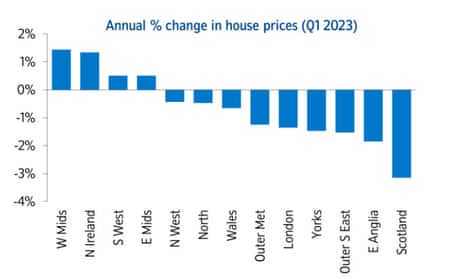

All regions of the UK saw a slowing in price growth in Q1, with most seeing small year-on-year falls. West Midlands was the strongest performing region, while Scotland remained the weakest.

Robert Gardner, Nationwide’s chief economist, explains:

“March saw a further decline in annual house price growth, with prices down 3.1% compared with the same month last year. March also saw a further monthly price fall (-0.8%) – the seventh in a row – which leaves prices 4.6% below their August peak (after taking account of seasonal effects).

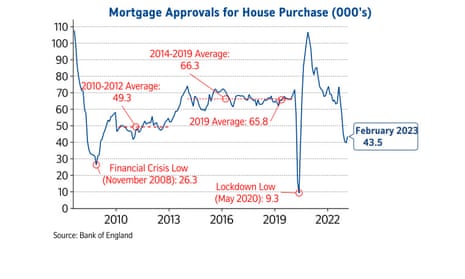

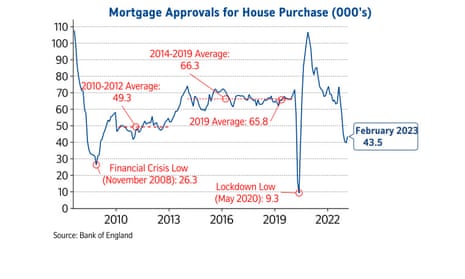

“The housing market reached a turning point last year as a result of the financial market turbulence which followed the mini-Budget. Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago.

Key events

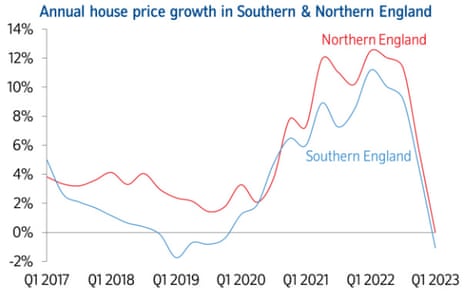

Prices falling faster in the South

There’s a North-South divide in UK house prices.

Across northern England overall (the North, North West, Yorkshire & The Humber, East Midlands and West Midlands), prices were flat year-on-year in the last quarter.

But in southern England (te South West, Outer South East, Outer Metropolitan, London and East Anglia), they fell 1.1% compared with Q1 2022.

Northern Ireland saw “a noticeable slowing in annual house price growth”, although prices were still up 1.3% year-on-year, Nationwide reports.

In Wales, annual house price growth turned negative – down from +4.5% to -0.7%.

Depending on where you are in the country the severity in prices changes differs significantly, with Scotland in particular feeling the cold pic.twitter.com/NenOhH7G6p

— Emma Fildes (@emmafildes) March 31, 2023For the 7th month in a row house prices fall. In March house prices dropped to £257,122. This is a -3.1% year-on-year drop and a -0.8% monthly fall which leaves prices 4.6% below their Aug peak (after taking account of seasonal effects) @AskNationwide pic.twitter.com/c2goQ1uM6x

— Emma Fildes (@emmafildes) March 31, 2023Most regions see small year-on-year house price falls

House prices in nine out of 13 British regions recorded annual house price declines in the first quarter of this year, Nationwide reports.

Chief economist Robert Gardner says:

Scotland remained the weakest performing region with prices down 3.1% compared with a year ago, a sharp slowing from the 3.3% year-on-year increase the previous quarter.

East Anglia, which was the strongest performing region last quarter, saw a significant slowdown, with prices falling 1.8% year-on-year, making it the weakest performing English region. The neighbouring Outer South East saw a 1.5% yearon-year decline, while London saw a 1.4% fall.

The UK housing market may remain weak in the coming months.

Nationwide’s chief economist, Robert Gardner, says:

“It will be hard for the market to regain much momentum in the near term since consumer confidence remains weak and household budgets remain under pressure from high inflation.

Housing affordability also remains stretched, where mortgage rates remain well above the lows prevailing at this point last year.

UK house prices in biggest fall since 2009

UK house prices are falling at the fastest annual rate since the aftermath of the financial crisis, new data from Nationwide shows.

Nationwide reports that UK house prices fell for the seventh month running in March, as the aftermath from the disastrous mini-budget continued to hammer the housing market.

This month, they fell by 3.1% compared to a year ago, which is the largest annual decline since July 2009, Nationwide Building Society said.

Across the UK, prices fell by 0.8% month on month, leaving the average UK house price at £257,122.

All regions of the UK saw a slowing in price growth in Q1, with most seeing small year-on-year falls. West Midlands was the strongest performing region, while Scotland remained the weakest.

Robert Gardner, Nationwide’s chief economist, explains:

“March saw a further decline in annual house price growth, with prices down 3.1% compared with the same month last year. March also saw a further monthly price fall (-0.8%) – the seventh in a row – which leaves prices 4.6% below their August peak (after taking account of seasonal effects).

“The housing market reached a turning point last year as a result of the financial market turbulence which followed the mini-Budget. Since then, activity has remained subdued – the number of mortgages approved for house purchase remained weak at 43,500 cases in February, almost 40% below the level prevailing a year ago.

Real households’ disposable income (RHDI) increased by 1.3% in the October-December quarter, the ONS reports.

That follows four consecutive quarters of negative growth, as people’s income was squeezed by rising inflation.

Disposable income was boosted by the UK’s Energy Bills Support Scheme – the £400 paid to households over the last six months.

Those payments are ending today, though.

The UK services sector grew by 0.1% in the final quarter of last year, the ONS reports.

Builders had a good quarter, with the construction sector growing by 1.3%.

But the production sector stagnated, with growth was flat in Quarter 4 2022.

However, the UK economy is still below its pre-pandemic level.

Quarterly GDP in Quarter 4 2022 was 0.6% below its pre-coronavirus (COVID-19) level set in Q4 2019, which has been revised up from the previous estimate of 0.8% below.

GDP is now estimated to have increased by 4.1% in 2022, revised up from the previous estimate of 4.0%.

Another boost – the Office for National Statistics has revised up UK GDP in the third quarter of last year.

GDP is now thought to have only fallen by 0.1% in July-September, better than the first estimate of a 0.2% decline.

UK avoids recession after growing in Q4 2022

Newsflash: Britain has avoided falling into recession at the end of last year

New data from the Office for National Statistics has shown that national output grew by 0.1% the final three months of 2022 – better than the earlier estimate of no change in GDP in October-December.

The economy shrank in the third quarter of last year, but today’s data confirms that the economy has not shrunk for two successive quarters which is the technical definition of recession.

Update: ONS director of economic statistics Darren Morgan explains that new data shows that the UK’s telecommunications, construction and manufacturing firms all fared better than initially thought in the latest quarter.

More to follow….

UK business confidence hits ten-month high

Encouragingly, UK business confidence has risen to its highest level since May 2022.

The Lloyds Bank Business Barometer, released this morning, has risen this month by 11 points to 32%, helped by rising optimism about the outlook for the economy.

Overall economic optimism also increased this month. And pricing expectations, which are being watched by the Bank of England amid worries about ‘greedflation’, cooled to a six-month low.

Hann-Ju Ho, senior economist at Lloyds Bank Commercial Banking, says:

“Business confidence has seen a surge this month with economic optimism and trading prospects bolstering firms. With hiring intentions improving, we may see employment growth picking up in the coming months. Tentative signs of easing wage pressures suggest that businesses’ difficulties in finding staff may have started to ease.

“Although the measures in the Budget were widely trailed, it is yet to be seen what the full impact of the Chancellor’s announcement, along with the surprise rise in inflation and recent increase in interest rates, will have had on business confidence.”

A lot of people in government will be hoping don’t get a downward revision to UK GDP this morning, says Michael Hewson of CMC Markets.

When the numbers were last adjusted the UK economy managed to avoid a technical recession by the skin of its teeth, coming in at 0%, after a -0.2% contraction in Q3.

The rebound in Q4 was helped in some part by a strong rebound in consumer spending due to the Football World Cup in Qatar, and today’s final adjustment will hope that this holds, with personal consumption expected to come in at 0.1%.

Recent retail updates have offered encouragement that consumers are still spending, albeit more cautiously, while the construction sector has also shown signs of some improvement. Business investment also saw a rebound in Q4 after a slowdown in Q3.

Even with the optics of avoiding a technical recession, the outlook for the UK economy remains challenging with headline inflation still close to 10%, and consumer confidence still very fragile, but the rebound seen in retail sales seen in January and February offers hope that Q1 could see some growth after a difficult end to 2022.

Introduction: UK GDP and Nationwide house price index in focus

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The UK economy is in focus today as we get updated GDP data covering the final quarter of last year, and a healthcheck on the housing market this month.

At 7am, the Office for National Statistics releases its UK “quarterly national accounts” for October to December 2022, which gives a detailed view of how the economy performed.

The first estimate of GDP in Q4 2022, released in February, showed that the economy stagnated. That meant Britain narrowly avoided a technical recession, having also shrunk in Q3.

Today’s data could confirm that, and will also give more detail about different parts of the economy fared. It will also show how households’ disposable income changed in the quarter, how prices changed over the quarter, and if households saved more, or less.

Building society Nationwide releases its March House Price Index at 7am too. Economists predict that average prices fell again this month, down by 0.3% after a 0.5% month-on-month drop in February.

It’ll be a busy day for economic news, as we also get new inflation data on both sides of the Atlantic.

Eurozone inflation is forecast to have slowed this month, to 7.1% from 8.5% in February, after inflation in Spain and Germany fell yesterday.

But underlying inflation is not falling as fast, as Ipek Ozkardeskaya, senior analyst at Swissquote Bank, explains:

First CPI figures from Spain and Germany confirmed that headline inflation in Europe eased by a big chunk in March, thanks to the base effect - as we now compare war months to war months.

Released yesterday, the German inflation fell from 9.3% to 7.8%, and inflation in Spain halved, from 6% to 3.1%.

Chic, but not enough.

When we filter out the energy and food prices – which exploded with the war – the inflation picture is not as optimistic. In fact, core inflation in Spain barely fell this month, from 7.6% to 7.5%.

And core inflation in the Eurozone is expected to rise to a fresh record high.

The US Personal Consumption Expenditures (PCE) index, is released too. A month ago, PCE rose unexpectedly to 5.4%, adding pressure for more rate hikes.

Core PCE, which is the Federal Reserve’s favourite inflation measure, is forecast to remain at 4.7% this month, matching January’s figure.

The agenda

7am BST: UK GDP quarterly national accounts: October to December 2022

7am BST: UK Balance of payments: October to December 2022

7am BST: Nationwide’s house price index for March

7am BST: German retail sales for February

10am BST: Eurozone inflation (flash estimate) for March

10am BST: Eurozone unemployment

1.30pm BST: US PCE inflation report for February

3pm BST: University of Michigan survey of US consumer sentiment.

1 year ago

60

1 year ago

60

English (US)

English (US)