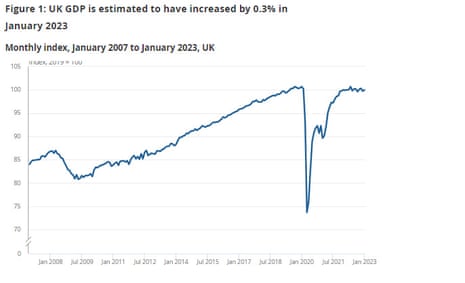

UK GDP: economy grew by 0.3% in January

Newsflash: The UK economy has returned to growth.

The Office for National Statistics reports that GDP grew by 0.3% during January, after shrinking by 0.5% in December.

That’s a faster recovery than expected after the economy stalled in the final quarter of 2022.

Analysts had expected modest growth of just 0.1% (see opening post), as strike action and the cost of living crisis prevented a recovery in consumer and business activity.

The latest GDP figure could give the chancellor, Jeremy Hunt, a slight boost before next week’s budget, when he will set out the government’s tax and spending policies.

Key events

Yael Selfin, chief economist at KPMG UK, fears a UK recession is “still on the cards” despite the brightening economic outlook.

Selfin says:

“The marked fall in wholesale gas prices and easing of supply chain disruptions provided a welcome boost to economic prospects at the start of 2023. But this may not be sufficient to stave off a recession in the first half of this year, as consumer spending remains weak with households continuing to be squeezed by elevated prices and higher interest rates.

“However, we expect the current downturn to be shallower and shorter than previously thought, with stronger business sentiment and a steady fall in inflation expected to support the recovery in the second half of the year. Although our latest forecasts see the UK set for a 0.4% fall in GDP this year and only 0.6% growth in 2024 overall due to the weak start and the lack of fiscal momentum and business investment to bolster medium term recovery.

UK GDP report a boost to Hunt

The return to growth in January indicates the UK may avoid falling into a recession, says Victoria Scholar, Head of Investment at interactive investor:

“UK GDP came in flat year-on-year in the three months to January, above expectations for a drop of 0.1%. The monthly figure rose by 0.3% following a fall of 0.5% in December and topping forecasts for a rise of 0.1%.

Driving January’s gain was an uptick in the service sector output which grew by 0.5% following a drop of 0.8% in December with education and a return to normal levels of school attendance as well as a pick up in postal and courier activities. Real estate activities however was the only services subsector in negative territory amid the rise in mortgage rates and subdued housing market activity.

Consumer-facing services grew by 0.3% in January recovering from a drop of 1.2% in December thanks to the resumption of Premier League football which strengthened demand for sports and recreation. However they are stuck 8.6% below their pre-covid levels from February 2020.

While services improved, manufacturing shrank falling by 0.4% with over half of its subsectors in decline and construction also fell sharply by 1.7%.

Heavy industrial action weighed on education and postal service activity in December, with a reduction in strikes in January prompting a rebound in activity to start the year. The end of the FIFA World Cup and the resumption of the Premier League also helped drive demand for football related spending.

For now it looks like the UK is on track to avoid a recession with January’s monthly growth figure landing fractionally above zero. When combined with the government’s unexpected budget surplus in January, the data is well timed for the Treasury and could give Chancellor Jeremy Hunt some wiggle room around his Budget plans next Wednesday.

In light of the data, the pound is gaining some strength against the US dollar going against the decline over the past year. An appreciating sterling helps to provide a natural offset to UK inflationary pressures.”

It is “encouraging” that the economy expanded a little as we entered the New Year, following the contraction in December, says Kitty Ussher, chief economist at the Institute of Directors.

Ussher points out that the economic picture is better than feared last November, which could give Jeremy Hunt more ‘room to manoeuvre’ in the Budget next Wednesday.

The data has been helped by a resumption of business-as-usual in the education and postal sectors, and a return to the full Premier League schedule following the end of the World Cup. It is also encouraging that the retail sector demonstrated growth, albeit slight, given pressures on household budgets.

“While a flat economy overall is not usually grounds for celebration, the fact that these results are more positive than was expected at the time of the Chancellor’s Autumn Statement in November gives him more room for manoeuvre in next week’s Budget. The priority now is to use that flexibility to help put Britain on a sustainable growth path for the rest of the year and beyond.”

Hunt: UK economy has proved more resilient than many expected

The UK economy has been “more resilient” than expected, chancellor Jeremy Hunt says, after growing by a better-than-expected 0.3% in January.

“In the face of severe global challenges, the UK economy has proved more resilient than many expected, but there is a long way to go.

“Next week, I will set out the next stage of our plan to halve inflation, reduce debt and grow the economy - so we can improve living standards for everyone.’’

Private healthcare boosted GDP

The was increased demand for private healthcare in January, the GDP report shows, as NHS waiting lists grew longer.

Human health and social work activities grew by 0.7% in January, following a fall of 2.8% in December 2022.

January saw growth of 1.1% in human health activities driven by “increased output in the private sector”, the ONS says.

One in eight adults in the UK paid for private medical care in 2022, data last December showed, due to long delays for NHS tests or treatment. Analysts have warned that waiting lists are unlikely to fall in 2023.

There was a bounceback in activity in postal activity in January, after Royal Mail staff held a series of strikes in December.

Transport and storage services grew by 1.6% in January; the main contributor was an increase of 6.4% in postal and courier activities.

“This growth comes after a fall of 10.5% in December 2022, which was partly because of the impact of postal strikes,” the ONS says.

In January 2023, school attendance levels returned to normal levels following a significant drop in December 2022, the ONS says.

That lifted activity in the education sector (as more children were being educated).

ONS: Zero growth over last 12 months

The economy “partially bounced back from the large fall seen in December” in January, says ONS director of economic statistics Darren Morgan.

But, Morgan also points out that the UK economy has stagnated over the last year.

Morgan explains:

“Across the last three months as a whole and, indeed over the last 12 months, the economy has, though, showed zero growth.

“The main drivers of January’s growth were the return of children to classrooms, following unusually high absences in the run-up to Christmas, the Premier League clubs returned to a full schedule after the end of the World Cup and private health providers also had a strong month.

“Postal services also partially recovered from the effects of December’s strikes.”

Monthly GDP was broadly flat in January 2023 compared with the same month last year, the ONS says.

That means the UK economy has not managed to grow over the last 12 months.

UK GDP: the details

The UK’s services sector drove growth in January, by expanding by 0.5% during the month.

The main contributing sectors were education (2.5%), as school attendance returned to November 2022 levels, and arts entertainment and recreation following the resumption of Premier League football.

But the UK’s production sector shrank by 0.3% while construction output decreased by 1.7%.

Here are the details:

The services sector grew by 0.5% in January 2023, after falling by 0.8% in December 2022, with the largest contributions to growth in January 2023 coming from education, transport and storage, human health activities, and arts, entertainment and recreation activities, all of which have rebounded after falls in December 2022.

Output in consumer-facing services grew by 0.3% in January 2023; this follows a fall of 1.2% in December 2022.

Production output fell by 0.3% in January 2023, following growth of 0.3% in December 2022.

The construction sector fell by 1.7% in January 2023 after being flat in December 2022.

Despite growing in January, the UK economy is still 0.2% smaller than in February 2020, when the Covid-19 pandemic hit.

Looking at the broader picture, though, GDP was flat in the three months to January 2023.

UK GDP: economy grew by 0.3% in January

Newsflash: The UK economy has returned to growth.

The Office for National Statistics reports that GDP grew by 0.3% during January, after shrinking by 0.5% in December.

That’s a faster recovery than expected after the economy stalled in the final quarter of 2022.

Analysts had expected modest growth of just 0.1% (see opening post), as strike action and the cost of living crisis prevented a recovery in consumer and business activity.

The latest GDP figure could give the chancellor, Jeremy Hunt, a slight boost before next week’s budget, when he will set out the government’s tax and spending policies.

Alvin Tan of RBC Capital Markets predicts the UK grew by 0.1% in January – but that might not stop the economy shrinking during the current quarter….

January’s UK dataflow has been somewhat mixed, but the details of the January PMIs, the services PMI in particular, painted a more positive picture than the headline readings suggested in our view. We look for January GDP (Friday) to grow at 0.1% m/m.

Although such an outcome would still mean it is possible for Q1 GDP as a whole to fall, it equally means that any contraction will be small and likely temporary.

Introduction: UK GDP report today after bank share selloff

Good morning

We’re about to discover if the UK economy has returned to growth after struggling at the end of last year.

January’s GDP report, due at 7am, will show if the economy expanded or not in the first month of 2023. It’s the final healthcheck on the economy before next Wednesday’s budget.

Economists predict UK GDP may have crept up by 0.1% in January, after the economy stagnated in the final quarter of 2022.

A month ago, we learned that in December alone, the economy shrank by 0.5% as strikes in the public sector, rail and postal services.

There have been signs that the economy might be a little stronger than feared.

The British Chambers of Commerce (BCC) forecast on Wednesday that the UK economy is on track to shrink less than expected this year and avoid the two quarters of negative growth which mark a technical recession.

And last week, the Bank of England’s chief economist said Britain’s economy is showing slightly more momentum than expected.

As Huw Pill put it:

“Survey indicators that have become available since the publication of the forecast have surprised to the upside, suggesting that the current momentum in economic activity may be slightly stronger than anticipated.”

Also coming up today

A heavy selloff in US bank shares last night has sent jitters through the financial markets today.

European stocks are expected to fall over 1% when trading begins:

Last night’s sell-off in JPMorgan Chase (-5.4%), Bank of America (-6.2%), Citigroup (-4%) and Wells Fargo (-6.2%) came after a small technology-focused lender called Silicon Valley Bank announcd a capital raise, which sent its stock collapsing by 60%.

Reuters explains:

SVB, which does business as Silicon Valley Bank, launched a $1.75 billion share sale on Wednesday to shore up its balance sheet. It said in an investor prospectus it needed the proceeds to plug a $1.8 billion hole caused by the sale of a $21 billion loss-making bond portfolio consisting mostly of U.S. Treasuries. The portfolio was yielding it an average 1.79% return, far below the current 10-year Treasury yield of around 3.9%.

Investors in SVB’s stock fretted over whether the capital raise would be sufficient given the deteriorating fortunes of many technology startups that the bank serves. The company’s stock collapsed to its lowest level since 2016, and after the market closed shares slid another 26% in extended trade.

Another California bank, Silvergate Capital Corp, had announced a voluntary liquidation this week, after mass withdrawal of deposits after collapse of FTX exchange.

The latest US Non-Farm Payroll is expected to show that around 205,000 new jobs were created in America last month, down from the unexpectedly strong 517,000 in January.

The agenda

7am GMT: UK GDP report for January

1.30pm GMT: US Non-Farm Payroll report

3pm GMT: European Central Bank president Christine Lagarde visits German Federal Chancellor Olaf Scholz

1 year ago

69

1 year ago

69

English (US)

English (US)