Key events

Swiss bank UBS predicts the US dollar will weaken further against other major currencies over the next six to 12 months.

That’s because the US Federal Reserve may pause its interest rates hikes earlier than other major central banks, with the US economy at risk of recession.

Mark Haefele, chief investment officer at UBS Global Wealth Management, explains:

“With the US economy losing its growth advantage and the rate premium likely to narrow, we advise investors to hedge their dollar exposure, favoring the Australian dollar, the yen, and gold.”

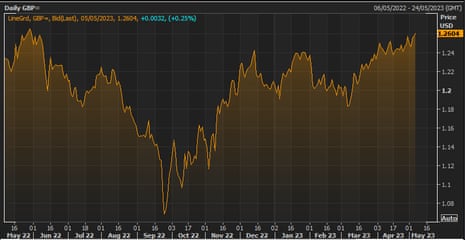

Introduction: Pound highest in over 11 months against US dollar

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

The pound has climbed to its highest level against the dollar in almost a year, as fears over the health of the global economy and the health of US regional banks grip the markets.

Sterling hit $1.263 this morning, the highest level since late May 2022. Quite a recovery since last autumn, when it plumbed record depths around $1.03 after the mini-budget shambles.

The pound is being supported by encouraging economic data this week, showing a pick-up in UK mortgage applications, service sector growth, and car sales.

The dollar has weakened despite the Federal Reserve lifting US interest rates to a 16-year high this week, with traders noting that the Fed could soon end its tightening cycle.

The Bank of England is expected to raise interest rates next Thursday, to 4.5%, with the markets now pricing in one additional hike before the end of the year.

Today’s US employment report will show if America’s jobs market is cooling. Economists predict 180,000 new jobs were created in April, which would be a slowdown on March’s 236,000.

Also coming up today

America’s banking sector remains in turmoil, after shares in several regional lenders fell again yesterday.

PacWest Bancorp shed 50% by the close of trading last night, with First Horizon losing a third of its value. Western Alliance, which firmly denied a report it was exploring a potential sale, lost almost 40%.

PacWest had sought to calm markets on Wednesday and said it was in talks with several potential investors after its shares fell by as much as 60%. But the sell-off continued on Thursday and affected other regional banks.

“We believe the banks are having their GameStop-like moment, where social media is amplifying non-traditional approaches to assessing solvency,” Jaret Seiberg, TD Cowen analyst, wrote in a note, adding:

“This creates a self-fulfilling prophecy that pressures stock prices, which then leads to more questions.”

Another bank, HSBC, will also be in the spotlight today as it holds its annual general meeting. Investors will vote on a resolution calling for a spinoff of HSBC’s Asia business, backed by top shareholder Ping An, but opposed by the bank’s board.

The agenda

7am BST: German factory orders for March

9.30am BST: UK construction PMI for April

10am BST: Eurozone retail sales for March

11am BST: HSBC’s AGM

1.30pm BST: US jobs report for April

1 year ago

125

1 year ago

125

English (US)

English (US)